Eliminate Bad Debt – The Silent Wealth Destroyer

In a previous video I talked about the difference between good and bad debt. In this video we will focus on reducing or eliminating bad debt – the silent wealth destroyer.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Join my Wealth Bootcamp for FREE

Join my FREE Wealth Bootcamp to improve the Health of Your Wealth so you can have the life you want.

Don’t you think you deserve this?

Now the best way I know to get rid of bad debt is to use what I call the snowball method. Now let’s go through the snowball method step by step.

let’s go through the snowball method step by step.

Step 1 – Gather all the statements of the bad debts you have.

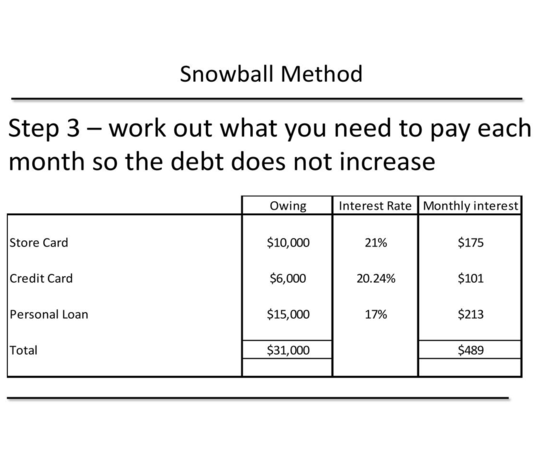

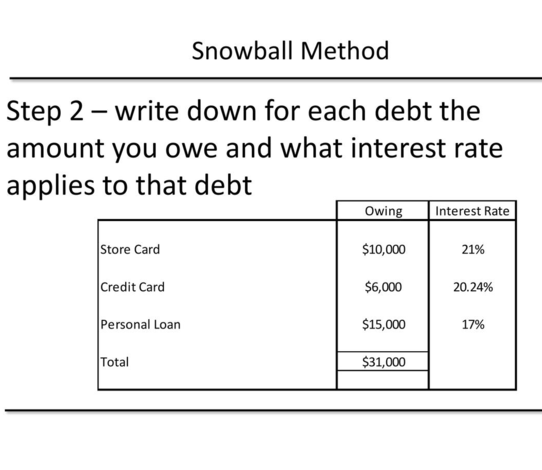

Step 2 – write down for each debt the amount you owe and what interest rate applies to that debt.

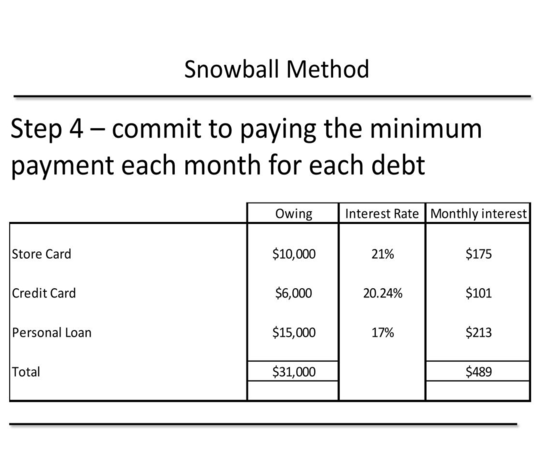

Step 4 – commit to paying the minimum payment each month for each debt. In this case you need to pay $489 per month to avoid the debt getting bigger..

Step 3 – work out what you need to pay each month so the debt does not increase. Simply multiply the debt by the interest rate and divide by 12.

The next step, step 5 is to work out how much extra you can pay to reduce your debts each month.

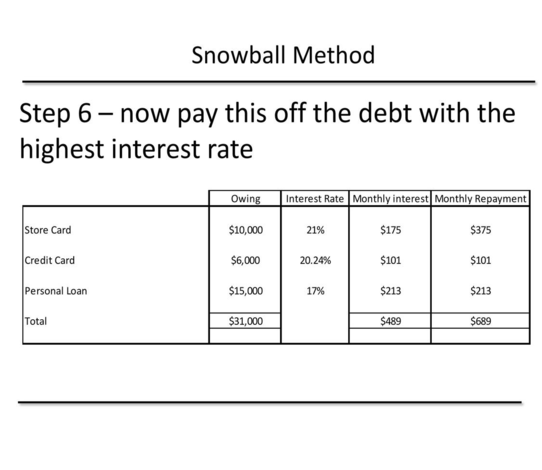

Step 6 – now pay this off the debt with the highest interest rate. Let’s say you could pay an extra $200 per month – then pay this off the Store card which has the highest rate.

You stick to this each month till the store card is paid off, then………..

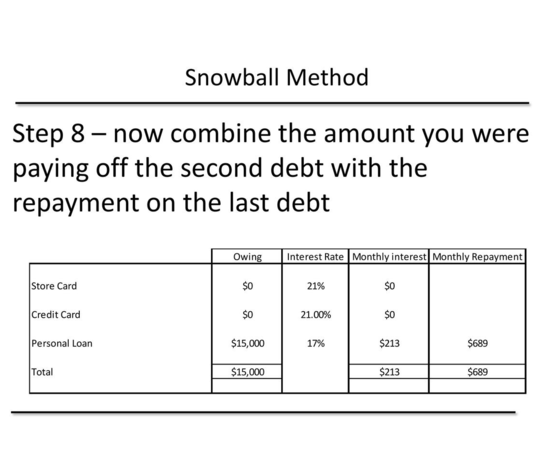

Step 8 – now combine the amount you were paying off the second debt with the repayment on the last debt. In this case you were previously paying $476 per month on the credit card and $213 on the personal loan. Now you pay $689 per month off the credit card.

You stick to this each month till the personal loan is paid off, then………..

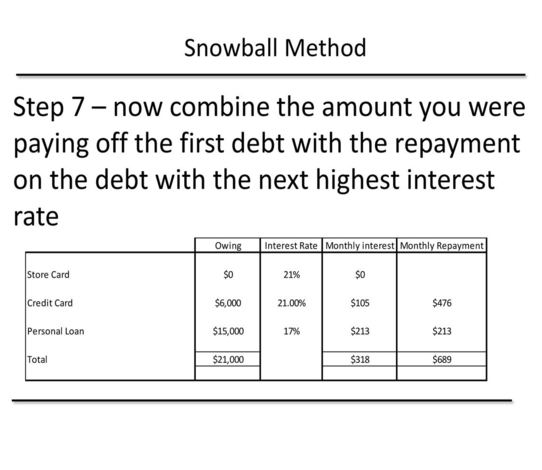

Step 7 – now combine the amount you were paying off the first debt with the repayment on the debt with the next highest interest rate. In this case you were previously paying $375 per month on the store card and $101 on the credit card. Now you pay $476 per month off the credit card.

You stick to this each month till the credit card is paid off, then………..

Now all your bad debt has been paid off.

Now you do not want to waste this pattern of putting extra money to use each month.

So the next step is to take the money you were using to pay off your bad debt each month and use this now to focus on growing your wealth.

Get your FREE copy of my new book Avoid the Poverty Trap

If you help cover some of the postage and handling, I will mail directly to your Australian letterbox, a FREE physical copy of my brand new book.

You will also get FREE silver membership to The Wealth Navigator Club.

Want to be notified when our next property is ready for sale?

If you like this, why not share this with a friend, simply click on one of the icons to the left or below