Why Your Super Will Never Be Enough

Introduction

There is a little known secret about your superannuation that the Government, the Banks and the Unions don’t want you to know!

Why do they want to keep it a secret?

Because between them, the Government, the banks and the unions have to be pulling over $15 billion dollars a year out of your superannuation.

And if you knew the truth, you might put your money somewhere else. Or you might want some accountability and we all know how much the government, the banks and the unions hate being held accountable for what they do.

And the secret is that your super will never be enough.

Simply watch the video below and read the examples under that to learn why.

Join my Wealth Bootcamp for FREE

Join my FREE Wealth Bootcamp to improve the Health of Your Wealth so you can have the life you want.

Don’t you think you deserve this?

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

Let’s look at some real life examples

Let’s consider the example of someone who began his or her superannuation contributions when they were age 20 and worked to age 65.

If they, like most people, only contributed the required amount (currently the 9.5 per cent of their income paid by their employer), then after tax they would “save” in their superannuation fund a bit over eight per cent of their income each year.

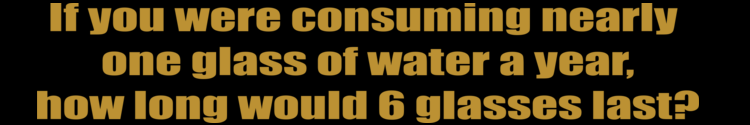

Imagine that a full glass of water / beer / wine (your choice) represents your annual income. Each year you drink most of it and put away just a small amount at the bottom of the glass (the eight per cent I mentioned above).

You do this for 45 years you end up with just 3.6 glasses of water (45 x 8 percent). Now with luck, the returns of the superannuation fund were better than inflation – big assumption I know! Let’s say your superannuation fund returned two per cent above inflation each year. This would turn these 3.6 glasses of water into just under six full glasses when you want to stop working. Now if your superannuation fund only returned one percent above inflation you would only have 4.6 glasses.

If the return was 2% above inflation you would have just under 6 glasses!

Now I have assumed you had superannuation for 45 years. What if:

- Superannuation was not around when you first started work?

- Superannuation was not always 9.5 per cent – which it was not?

- You left the workforce for a while (maybe to have a baby and raise your children).

- You are an overseas immigrant and started work in Australia at a later age?

Then the number of glasses you have when you stop working will be less.

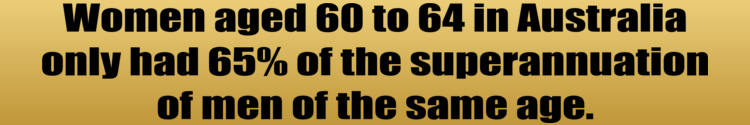

For example a recent review by BT Superannuation estimated that women aged 60 to 64 in Australia only had 65 per cent of the superannuation of men of the same age.

If you are like most people you have been spending all bar eight per cent of your glass each year. That’s right, you have been spending 92 per cent of your income after tax every year. So when you stop working do you think your spending will change much? I would say, probably not.

If you have six full glasses and you are spending 92 per cent of a glass each year, how long do you think your superannuation will last? About six or seven years.

If you only had 4.6 glasses, it would only last around five years.

What if you only had three glasses? Less again!

I have some great news and some bad news for you.

If you are a man, the average life expectancy in Australia for a male born now is nearly 80. That’s the great news. The bad news is that you have to live the last years of your life on the pension below the poverty line. How does that feel?

For a woman, the picture is going to be worse. The average life expectancy in Australia for a female born today is nearly 85. So you will live longer. That’s the great news. But as I mentioned above, as you are likely to have less to start with, you will be on the poverty line sooner, and longer! A very sobering and scary thought for all women.

Whether you are a man or a woman, here is another daunting fact facing many people today. According to RaboDirect’s 2014 Financial Health Barometer, nearly a quarter of Australians (24 per cent) don’t expect to pay off their home by the time they stop working.

If you were one of these people, that superannuation payout we talked about above won’t last five, six or seven years. Most likely, you would have to use this to pay out your home loan or sell your house, pay off the debt and downsize. Either way it is not a pleasant thought.

Even if you have some superannuation, it may already be set aside to pay off the mortgage.

Let’s have a look at Denise and David.

Denise is 65 and was earning $45,000 before tax (about $39,000 after tax). David is 67 and was earning $75,000 before tax (about $59,000 after tax).

Their current combined income after tax is about $98,000.

Denise has a superannuation balance of $112,000 and David has a balance of $198,000. This is a combined balance of $310,000. Denise’s superannuation was lower because of her lower wage and the fact that she took time off work to raise their children.

If they retired today they were facing a drop of over $64,000 per year in their income. They were one of the lucky ones and have managed to pay off their home loan. So they can use their superannuation to supplement their pension.

Now if they want to live to the same standard as they were living before they stopped worked, they would need to draw out of their superannuation about $64,000 per year. With a superannuation balance of $310,000, this would last about five years.

So in five years Denise would be 70 and David 72. They would have no superannuation left. They have no choice then but to live on the pension (or they could go back to work!). And this could be for long time. With today’s medical improvements, Denise has a life expectancy of around 85 and David nearly 80. So Denise could be living on the pension for 15 years and David nearly eight years.

So when Denise and David stop working they face several choices. Either continue spending the amount of money they were spending whilst working for the next 5 years. Then in five years they start to survive on the pension below the poverty line. Or reduce their standard of living now and spend less so their superannuation could last longer. Or continue to work part time to supplement the pension and their superannuation.

Either way Denise and David are forced to make a sacrifice in their living standards. Now or in five years.

What about Francis, a divorced IT specialist who is thinking of stopping work. She earns $110,000 per year before tax. This is about $81,000 after tax.

With a higher wage and no children her superannuation was just under $250,000. However she had not managed to pay off the mortgage on her expensive inner city apartment by the time she turned 65. Francis still owed $150,000. Now Francis faces different choices to David and Denise.

Francis could chose to sell her expensive inner city apartment, pay off her mortgage and buy a cheaper property somewhere else. This would leave her with the $250,000 in superannuation to top up the pension each year.

Or Francis could choose the stay near her friends and use $150,000 of her superannuation to pay off her mortgage. This leaves her with about $100,000 in superannuation to top up her pension. How long do you think this will last?

Just like Denise and David, whatever choice Francis makes will result in her having a reduced standard of living either now or sometime in the future.

I hope you now realise why your basic superannuation alone will not be enough.

Get your FREE copy of my new book Avoid the Poverty Trap

If you help cover some of the postage and handling, I will mail directly to your Australian letterbox, a FREE physical copy of my brand new book.

You will also get FREE silver membership to The Wealth Navigator Club.

Want to be notified when our next property is ready for sale?

Wayne Wanders

The Wealth Navigator

wayne@wealthbootcamp.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below